A subtle shift in Brussels has sent ripples through global EV markets.

Chinese electric vehicle makers, led by BYD, XPeng, and SAIC Motor, saw their shares climb sharply after the European Commission confirmed it is actively considering a minimum pricing mechanism as a potential alternative to punitive import tariffs. The development has injected cautious optimism into a trade dispute that has become one of the most sensitive fault lines between the EU and China.

In Hong Kong trading, BYD jumped nearly 5%, while XPeng surged over 5%. Back on the mainland, SAIC Motor gained more than 3%, reflecting renewed investor confidence that Europe may be softening its stance—at least partially.

A hard line, with a narrow opening

The EU’s position, however, remains anything but lenient.

While Brussels is open to replacing tariffs with minimum price commitments, the conditions attached are stringent. Under the framework outlined by the European Commission, any pricing undertaking must fully offset the impact of Chinese state subsidies, match the protective effect of tariffs, and be enforceable in real-world market conditions.

Most notably, the EU has rejected China’s push for a blanket minimum price across all electric vehicles. Instead, it is demanding model-by-model, configuration-specific pricing, calculated based on the final price paid by the first independent buyer in the EU. In effect, each EV must stand on its own economic footing.

Tariffs currently under discussion can reach 35.3%, making this pricing route one of the few viable paths for Chinese automakers to protect margins while maintaining access to Europe’s lucrative EV market.

Hybrids complicate the equation

One of Brussels’ biggest concerns lies beyond pure electric vehicles.

Chinese manufacturers that also sell hybrid vehicles in Europe face extra scrutiny. EU officials are wary of cross-subsidisation, where profits from one vehicle category could be used to undercut prices in another. That concern is not theoretical—imports of Chinese hybrids into the EU reportedly surged to five times last year’s levels during the first nine months of 2025.

To mitigate this risk, the Commission has signalled it may require sales volume caps or time-limited commitments as part of any minimum price agreement.

Volkswagen’s China-built EV under review

The policy debate has already moved from theory to practice.

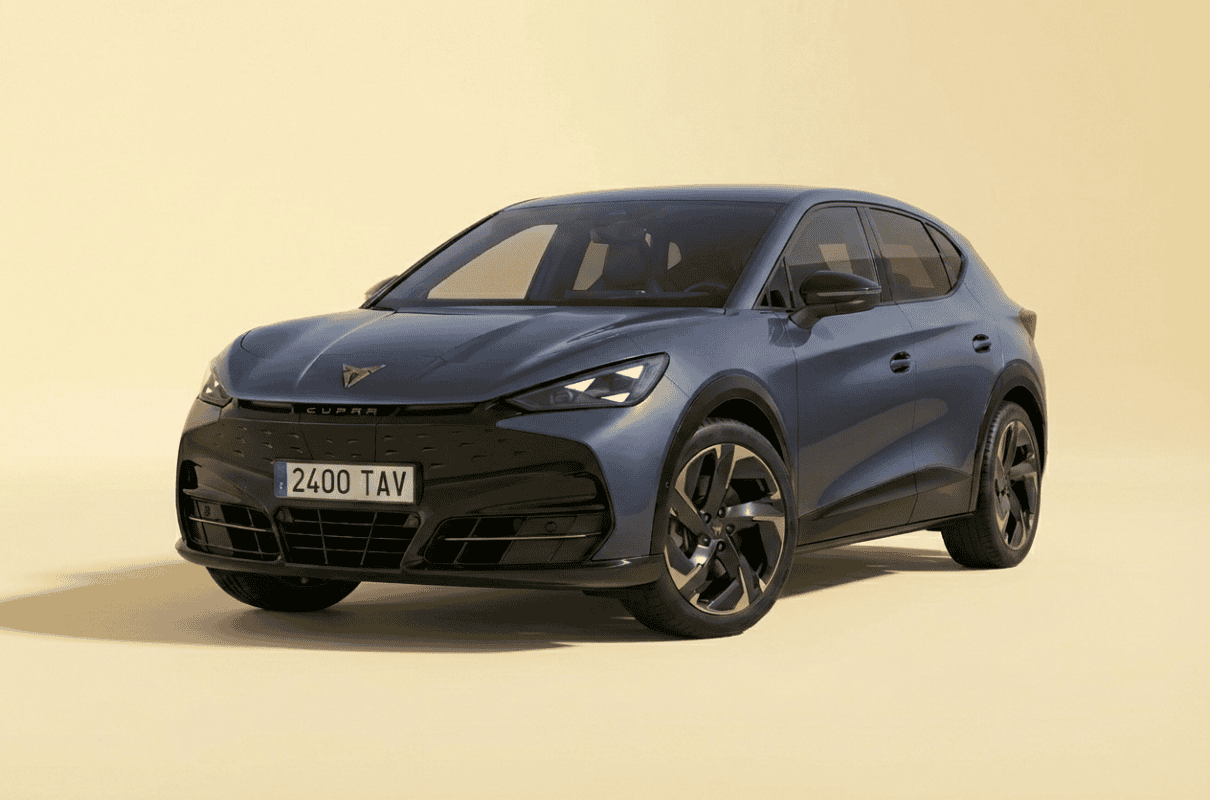

Last month, the Commission began reviewing a proposal involving Volkswagen’s Cupra Tavascan, an electric SUV produced in China. The offer combines minimum pricing with import quotas, potentially setting a precedent for how future agreements with Chinese manufacturers could be structured.

If approved, it could become a template—though not an easy one to replicate.

Beijing responds, markets react

China’s commerce ministry struck a measured but positive tone, welcoming the EU’s emphasis on non-discrimination and objective evaluation. Officials stressed that ongoing dialogue could still bridge the gap between protectionism and pragmatism.

For investors, the message was clear: the door is not closed.

While Europe remains determined to defend its automotive industry, it is also acknowledging the economic reality of a rapidly globalising EV supply chain. The resulting balancing act—between shielding domestic manufacturers and avoiding a prolonged trade confrontation—will shape not only the future of Chinese EVs in Europe, but also the broader dynamics of the global electric car market.

For now, markets are betting that compromise, however complex, is still on the table.

For more information & News related to BYD, please visit their official News website.

👉 Please 📩SUBSCRIBE to us for more real-world EV analysis, news, and deep dives — written for EV fans by EV fans.

Hey, I’m Badal! I’m super passionate about cars—especially electric ones. Whether it’s EVs, electric trucks, bikes, or anything with a battery and wheels, I’m all in. I love writing blogs and articles that break things down for fellow enthusiasts and curious readers alike. Hope you enjoy the ride as much as I do! Enjoyed reading? You can buy me a coffee on PayPal ☕ → paypal.me/BadalBanjare

[…] deal with BYD would provide Ford with a vital lifeline. The Chinese automaker is not only one of the world’s largest vehicle producers but also a major player in battery […]