Tesla’s CEO might be steering the company into risky territory again—this time to rescue his private AI venture. And if you hold Tesla stocks? You’re along for the ride, whether you signed up or not.

🚗 The Backstory: A $44 Billion Twitter Mistake That Won’t Die

In 2022, Elon Musk acquired Twitter for an eye-watering $44 billion—a deal that quickly turned sour. Within months, Fidelity dropped its valuation by 65%, which is not surprising, given the chaos that followed.

Musk had to offload large chunks of his Tesla stocks to finance the deal, which helped drive the stock price down. For many long-term Tesla investors, that move felt like a betrayal—not a strategy.

🤖 xAI: Musk’s New Toy, Tesla’s New Problem?

Fast-forward to 2023, and Musk quietly launched xAI, an artificial intelligence startup he owns entirely. This, despite years of claiming that Tesla was an AI company at its core—pushing breakthroughs in autonomous driving and robotics.

Many Tesla shareholders were confused. If Tesla is already focused on AI, why create a competing company? Worse, Musk suggested that Tesla might invest in xAI, raising concerns over misused company funds.

Add in the fact that he previously sold Tesla stocks to fund Twitter’s purchase—and now wants Tesla to double down by investing in xAI—and you’ve got a circular mess.

📉 Twitter Becomes X… Then Merges With xAI?

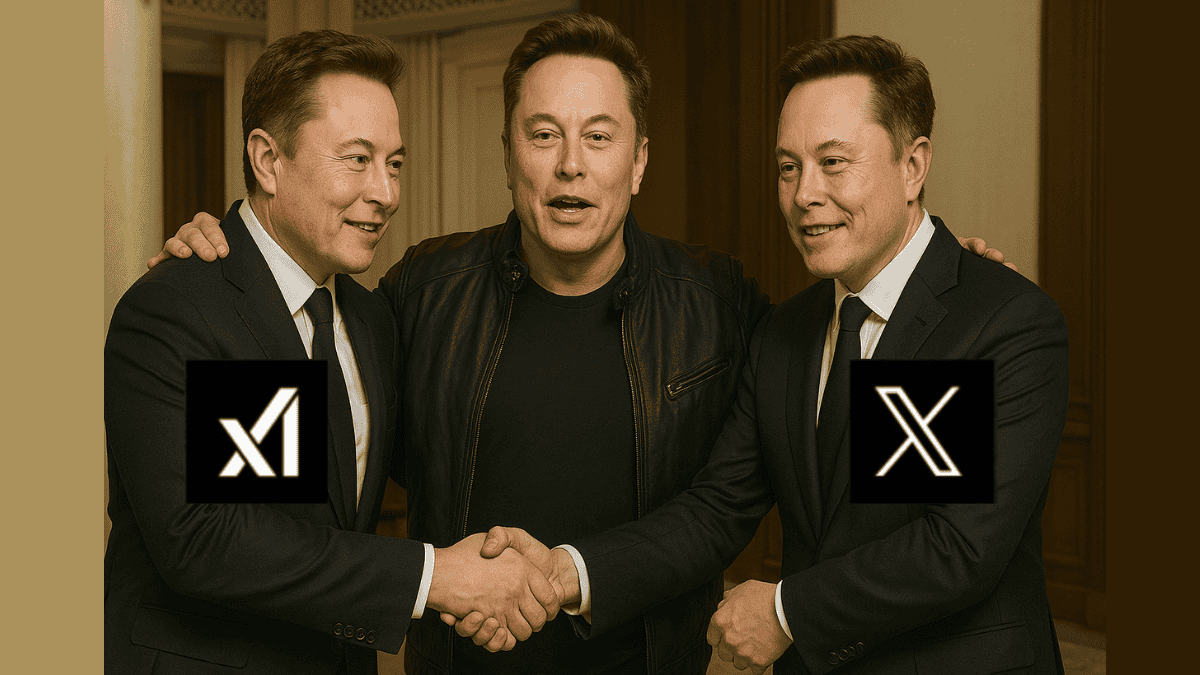

In early 2025, Musk pulled another surprise: xAI acquired Twitter (now rebranded as X) in an all-stock deal valued at $45 billion.

Here’s the kicker: Fidelity had estimated Twitter’s worth at only $10 billion just months earlier.

Even more eyebrow-raising? xAI, with no significant revenue, was valued at $80 billion during the acquisition. By the time the deal closed, the combined company’s valuation was somehow floating at $125 billion—despite absorbing $12 billion in debt.

So, who’s left holding the bag? Possibly Tesla. And more specifically—Tesla stockholders.

💰 How Tesla Stocks Could Be Impacted

Let’s break down the stakes for anyone holding Tesla stocks:

- Tesla’s stock price already took a hit when Musk sold shares to buy Twitter in 2022

- A new Tesla investment in xAI, especially if it’s done using stock, could dilute existing shares

- If Tesla injects cash instead, that’s money not going toward EV R&D, battery tech, or production

- Musk’s control of Tesla could increase since using undervalued Tesla stocks gives him more voting power

- Worst case? Tesla shareholders once again finance Musk’s personal ventures, which have minimal benefits for Tesla.

Musk has hinted at bringing xAI’s chatbot Grok into Tesla vehicles. Sure, it sounds futuristic. But Grok lags behind competitors like ChatGPT, and most analysts say xAI trails in the AI race.

Is that really where Tesla’s focus should be right now?

📉 Tesla’s Brand, Demand, and Stock Value Are Slipping

In early 2025, Tesla deliveries dipped, the Cybertruck’s rollout stumbled, and major markets like China became increasingly competitive.

Tesla stocks reflected that downturn, with shares falling over 30% from their mid-2023 highs.

Meanwhile, Musk has been pushing for Tesla to embrace AI and robotics more aggressively—two fields now dominated by xAI. And guess what? He’s likely to go to Tesla’s annual shareholder meeting in June to greenlight an investment in xAI.

Convenient timing after he inflated xAI’s valuation.

🗳️ Shareholders: Time to Pay Attention

Whether you actively trade or hold Tesla stocks through a mutual fund, ETF, or retirement account, you’re affected by these moves.

Musk’s long-term strategy seems increasingly centered around his personal ecosystem—not necessarily what’s best for Tesla’s EV mission or public shareholders.

A vote this June could allow Musk to transfer even more Tesla value into xAI. That would mean:

- Less capital for Tesla innovation

- More exposure to high-risk AI investments

- A murky future for Tesla’s core EV business

And if Tesla stocks continue to slide, Musk will gain more voting power per share, giving him even tighter control.

💬 Final Thoughts from the EV Community

At AboutEVs, we believe in tech and innovation. However, Tesla was built on electrifying transportation, not bailing out AI side projects.

If you’re a Tesla investor—directly or indirectly—you deserve transparency, accountability, and a strategy that prioritizes EV progress.

With Musk gearing up to push Tesla into xAI, the next few months could reshape the company’s direction—and seriously impact the value of Tesla stocks.

📅 What’s Next?

Keep an eye on Tesla’s annual shareholder meeting in June 2025. If Musk moves forward with his plan, Tesla’s priorities could significantly shift.

And if you own Tesla stocks, even passively, your financial future might be tied to that decision.

Want to stay updated on the latest Tesla news, stock moves, and EV trends?

👉 Please 📩SUBSCRIBE to us for more real-world EV analysis, news, and deep dives — written for EV fans by EV fan. It’s FREE!

Hey, I’m Badal! I’m super passionate about cars—especially electric ones. Whether it’s EVs, electric trucks, bikes, or anything with a battery and wheels, I’m all in. I love writing blogs and articles that break things down for fellow enthusiasts and curious readers alike. Hope you enjoy the ride as much as I do! Enjoyed reading? You can buy me a coffee on PayPal ☕ → paypal.me/BadalBanjare